Transformation with

a future

A new life for old walls

Redesign existing buildings on a grand scale to give them new purpose – the idea is anything but new. However, in the face of today’s – and tomorrow’s – challenges, this approach is currently experiencing a strong resurgence. What makes transformational real estate so exciting and attractive?

Corporate Report (PDF)read more

Transformation projects

Typical for pbb

Property highlights in major European cities: pbb supports investors in Europe and the US with financing for challenging projects. Below you will find a selection of noteworthy transactions for our clients.

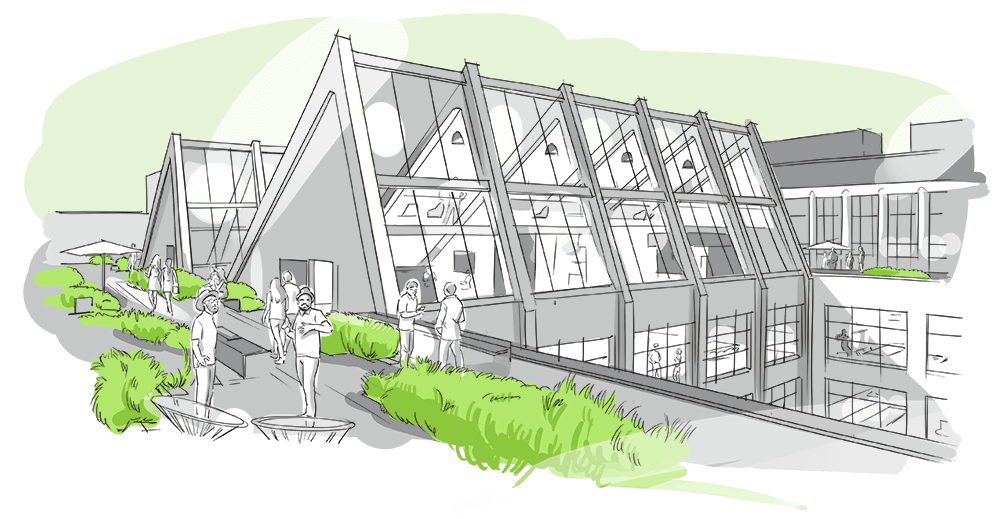

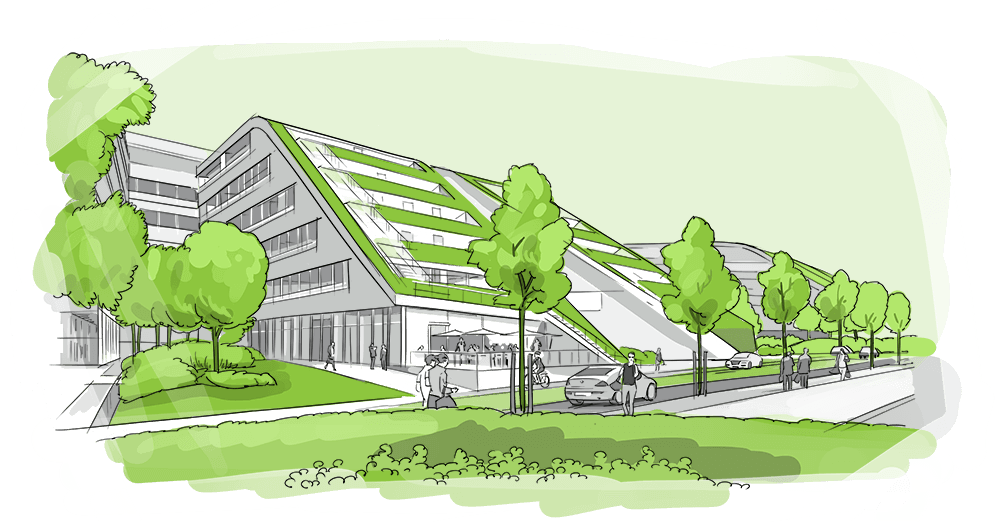

Denisstraße Lichthöfe,

Munich

Office building complex

A remarkable roof

The Lichthöfe project is an office complex on Munich’s Denisstrasse, which stands out on account of its saw-tooth roof – a series of glass ridges, which flood the buildings with light – and is a true eye-catcher. The complex, located on a 2,500 sqm site, consists of four building

structures with three verdant inner courtyards and will be completed by 2023. It offers an ideal working environment

for the future tenant – a renowned international technology company.

Home game

As an institution based near Munich, pbb is providing a €83 million loan to MünchenBau Bauträger GmbH to fund this architecturally distinctive office complex situated in a central location near Munich’s central railway station. MünchenBau has been active as a property developer in the Bavarian capital for over forty years and is a major local market participant.

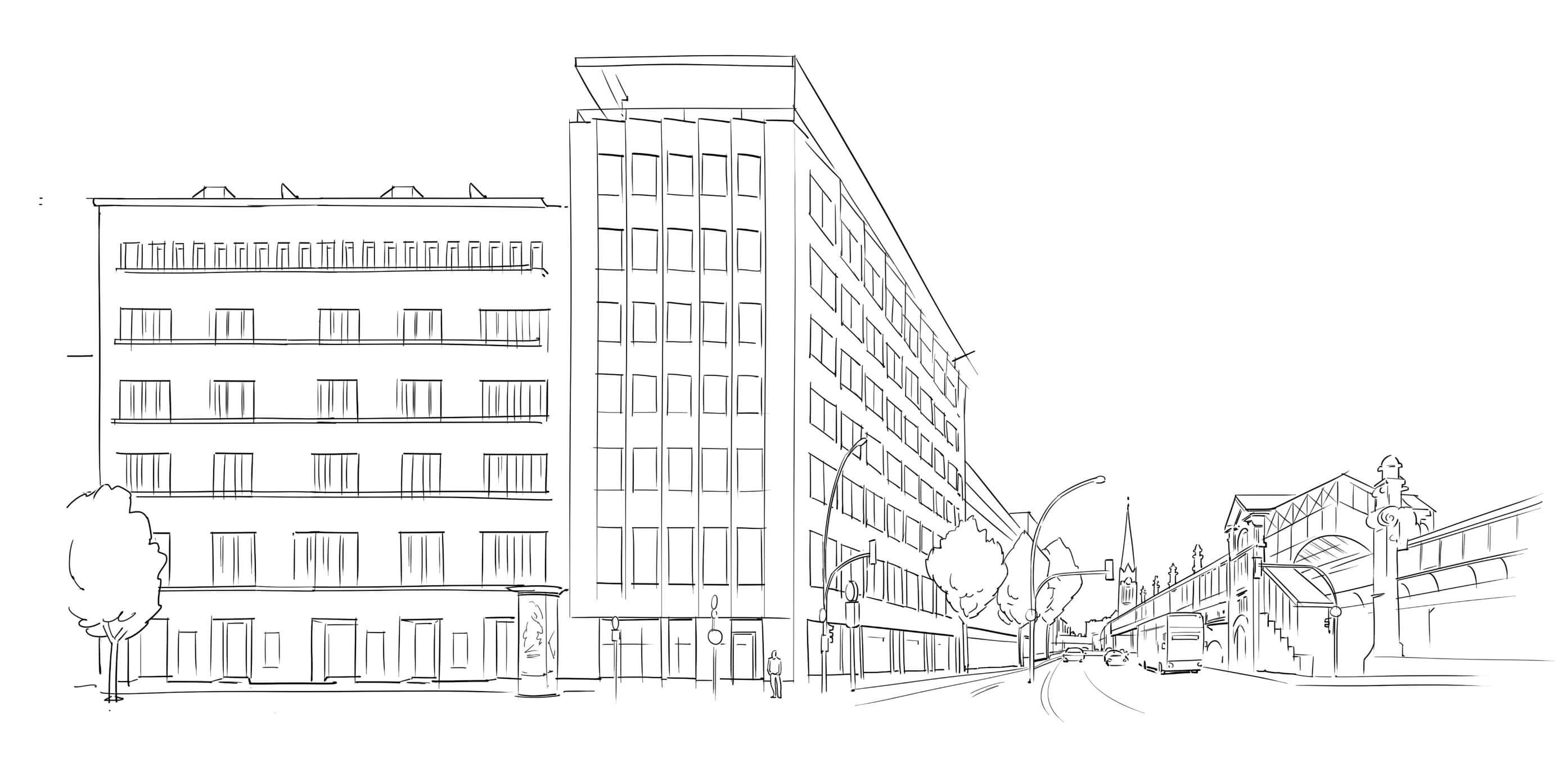

ABC-Bogen, Hamburg

Office buildings

The Hanseatic “Lemon Slice”

Just over twenty years old and already an architectural classic in Hamburg’s city centre, this office complex designed by Hadi Teherani consists of a front building with a distinctive wavy façade and a semicircular rear. Due to its prominent shape – with a continuous glass façade – locals call the light-flooded office building “the Lemon”.

Prime location investment

For the acquisition of the office building, pbb has provided a loan of around €80 million to Institutional Investment Partners GmbH, a real estate company. The property, which offers around 15,000 sqm of offices and 140 underground car parking spaces in an outstanding city-centre location, is let to a major international internet company.

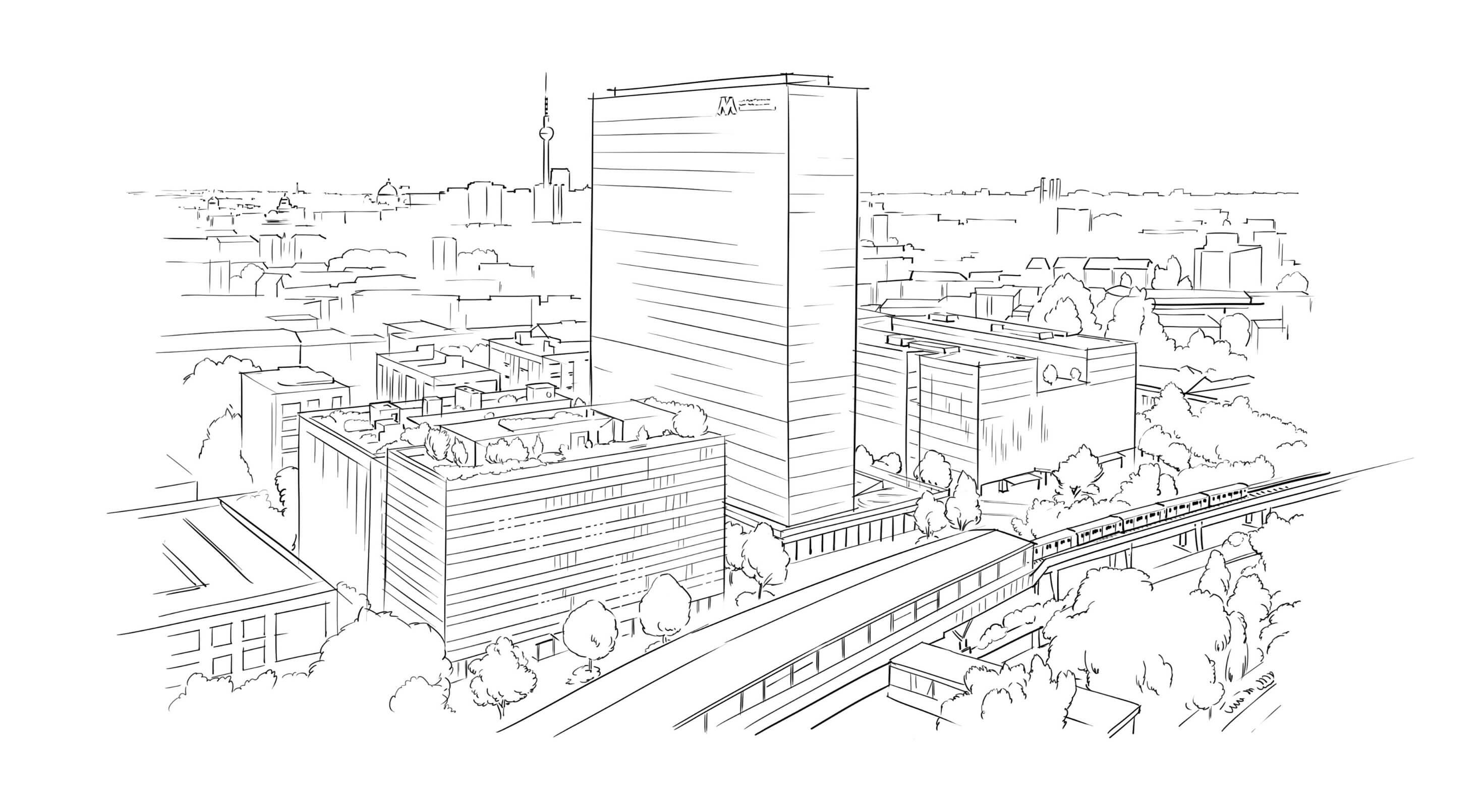

The Dock In, Prague

Mixed use property:

working – living – shopping

On the waterfront

Living and working with a view of the Vltava river and private docks, surrounded by lush greenery and only ten minutes away from Prague’s city centre – The Dock In offers all this. Development of the five-building complex in one of Prague’s prime locations began in 2013 and meets high quality and sustainability standards. The new quarter consists of office and retail spaces, along with more than 400 apartments. Many international companies have already moved into the four completed buildings as tenants.

Working together

pbb and Helaba have jointly provided a €130 million investment loan to Crestyl Group for refinancing of the Dock In Office Park. Acting as joint lead arrangers, the two financial institutions provided an equal share of the funding. In addition, pbb acted as facility agent and security agent for the transaction. For Czech real estate developer Crestyl, this has been the largest transaction with a syndicate of foreign banks to date.

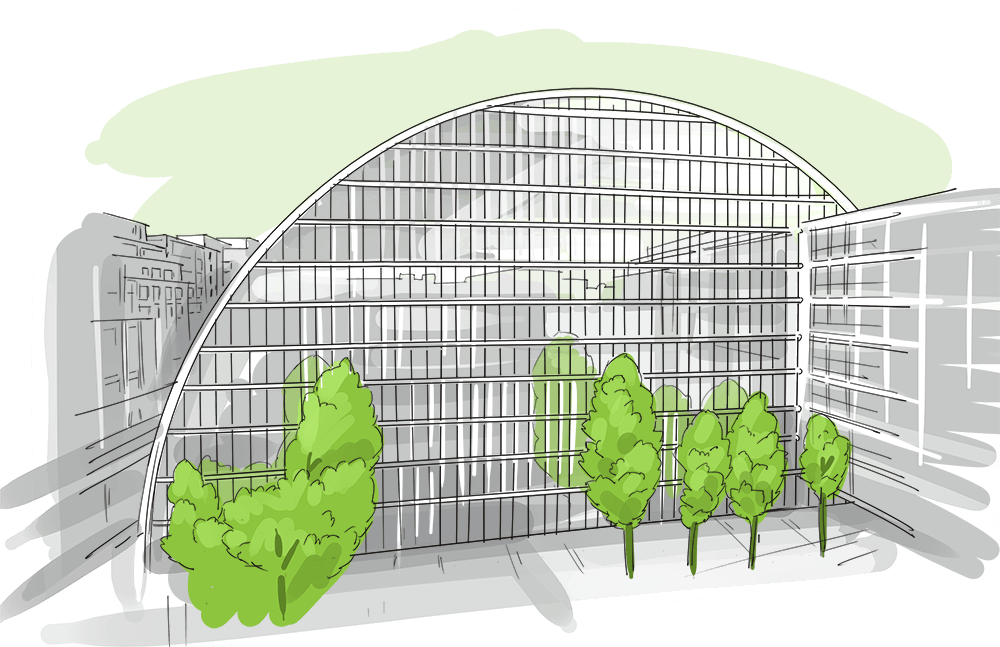

Ballet, Paris

Mixed Use:

retail – office

Classic beauty

Ornamental elements and decorations on the façade give a hint of the late 19th century in which the “Ballet” was built. The magnificent seven-storey building is located in the centre of Paris, near the opera house, and is currently undergoing extensive renovation. The building comprises almost 10,000 square metres of rental space. Once the renovations have been completed in 2024, it will continue to be used as a mixed-use property: there will be retail space on the ground floor and offices on the floors above.

Green soul

pbb’s acquisition and development financing has a volume of €173 million. After the refurbishment, the “Ballet” will not only shine in new splendour, but will also meet very high sustainability standards. Various certifications such as WELL V2 excellent, BREEAM RFO 2015 excellent and the WiredScore Gold label are being sought.

Leadership and Responsibility

We want to bring new products to the market, expand our US activities and extend more green loans.Andreas Arndt

Chairman of the Management Board and

Chief Financial Officer

With investment markets recovering, we have significantly increased new business volume in 2021 – thereby continuing our strategy to focus on core properties and acknowledging some uncertainty regarding future demand for rental space.Thomas Köntgen

Deputy CEO, Real Estate Finance and

Public Investment Finance

We focus on properties in good locations with stable cash flows and low re-letting risks. We also pay attention to professional investors with crisis management experience.Andreas Schenk

Member of the Management Board,

Chief Risk Officer

Supporting the change in the real estate sector towards more sustainability is a commitment to society and, at the same time, offers us business opportunities.Marcus Schulte

Member of the Management Board,

Treasurer

5 Top

news 2021

Awards, cooperation, ESG, green lending: What were the topics and events that drove pbb? A brief foray through the year 2021.

Read moreAbout pbb

Business model pbb

We structure medium- to large-sized financings for professional real estate investors, with a focus on office, retail, residential and logistics properties. Our clients benefit from the mix of local and international expertise that we offer.

Read moreSustainability at pbb

100% green energy Carbon-neutral power supply at all German pbb locations

Financial year in figures

17 CET1 ratio

40 Cost-income ratio

242 Pre-tax profit in € mn